COMMENTARIES

April 18, 2022

NFT Trading Risks Highlighted in Recent Lawsuits

OpenSea is facing three separate lawsuits from plaintiffs who lost access to their Bored Ape Yacht Club NFTs

Article At-A-Glance

Lawsuits have been filed against OpenSea by users who lost access to their NFTs, and surely more will follow. Frequent attacks on the biggest Non-Fungible Token (NFT) marketplace, OpenSea, is creating disgruntled victims and users.

- Three plaintiffs accuse OpenSea of negligence to consumer safety. One of the complaints is also suing LooksRare. Despite setbacks, OpenSea and the NFT industry continue to gain popularity.

- OpenSea’s vulnerability problems are an industry-wide issue.

- OpenSea has not responded to the legal complaints against them. However, the recent vulnerabilities of the platform are well known. In February, over $1.7 million in NFTs were lost to phishing attacks on the platform.

- The NFT industry has also been hit by a wave of litigation for copyright infringement. Companies including Nike, and Hermes have filed lawsuits against NFT projects.

Regardless, the NFT industry continues to rise in popularity and value. The industry that had over $40 billion in sales volume during 2021, is seeing multiple new patents filed for NFTs and metaverse-related development.

Non Fungible Tokens (NFTs) are uniquely identifiable digital assets whose authenticity has been certified on a blockchain, the transparent and secure digital ledgers that support the creation of many forms of digital assets, including NFTs and cryptocurrencies.

NFTs represent and track the ownership of nearly any real or intangible property in digital form, including works of art, images, music files, videos, virtual sports cards, physical objects, memberships, and countless other developing use cases.

Unlike regular cryptocurrencies or fiat money, NFTs cannot be mutually exchanged for one another because each NFT has a specific value based on its unique traits and attributes: they’re unique, provably scarce, tradeable, and usable across multiple applications.

Just like physical goods, you can do whatever you want with them! You can throw them in the trash, gift them to a friend across the world, or go sell them on an open marketplace. Unlike physical goods, however, they’re armed with all the programmability of digital goods.

NFT marketplaces are new as well. They provide trading platforms, somewhat like eBay or Amazon. OpenSea, and LooksRare, are virtual exchanges that allow digital collectors, to buy, sell, swap, and create NFTs. Where Amazon and eBay provide online marketplaces for traditional physical goods, NFT marketplaces provide online platforms for buyers and sellers to meet and exchange digital goods.

OpenSea is the world's first and largest NFT marketplace. In July, OpenSea processed $350 million in NFT trades. That same month, in a round led by Andreessen Horowitz, it raised $100 million in venture capital at a $1.5 billion valuation. In August, as NFT hype reached a fever pitch, volume spiked tenfold to $3.4 billion—an $85 million commission windfall for OpenSea in a month when it likely burned less than $5 million on expenses. Although transactions have since retreated to around $2 billion a month, the platform now has 1.8 million active users and a dominant share of the market. The company now boasts 70 employees and is recruiting many more, including much needed customer service reps.

Non Fungible Tokens (NFTs) are uniquely identifiable digital assets whose authenticity has been certified on a blockchain, the transparent and secure digital ledgers that support the creation of many forms of digital assets, including NFTs and cryptocurrencies.

Arguably, the NFT open-market approach heightens the risk of counterfeits, scams, and fraud. One accusation, for example, is that a scammer might copy an image of someone else’s art and sell it as an NFT on OpenSea. OpenSea is reportedly working on an automated way to spot fakes and has moderators who investigate suspicious offerings, but people can be a problem too. In September, OpenSea CEO Devin Finzer asked OpenSea’s head of product to resign after Twitter users discovered a crypto wallet linked to that executive was buying NFTs shortly before they appeared on the price-moving OpenSea home page. In other words, he was allegedly front-running his own employer’s decisions.

The incredible growth in NFTs combined with extremely valuable individual NFTs, weak security infrastructure, a largely unregulated market, and no recourse for victims to retrieve their stolen property has made NFT creators and owners natural targets for thieves. Even the savviest NFT owners can lose millions of dollars in a matter of seconds if they fall victim to a scam or a hack.

To date, the consensus is that the NFT marketplaces have done little to deter fraudulent activity on their platforms. They have instead created systems where thieves can act without fear of retribution or consequences. Indeed, crypto crime, of which stolen NFT transactions are included, accounted for a record-setting $14 billion worth of blockchain transactions in 2021.

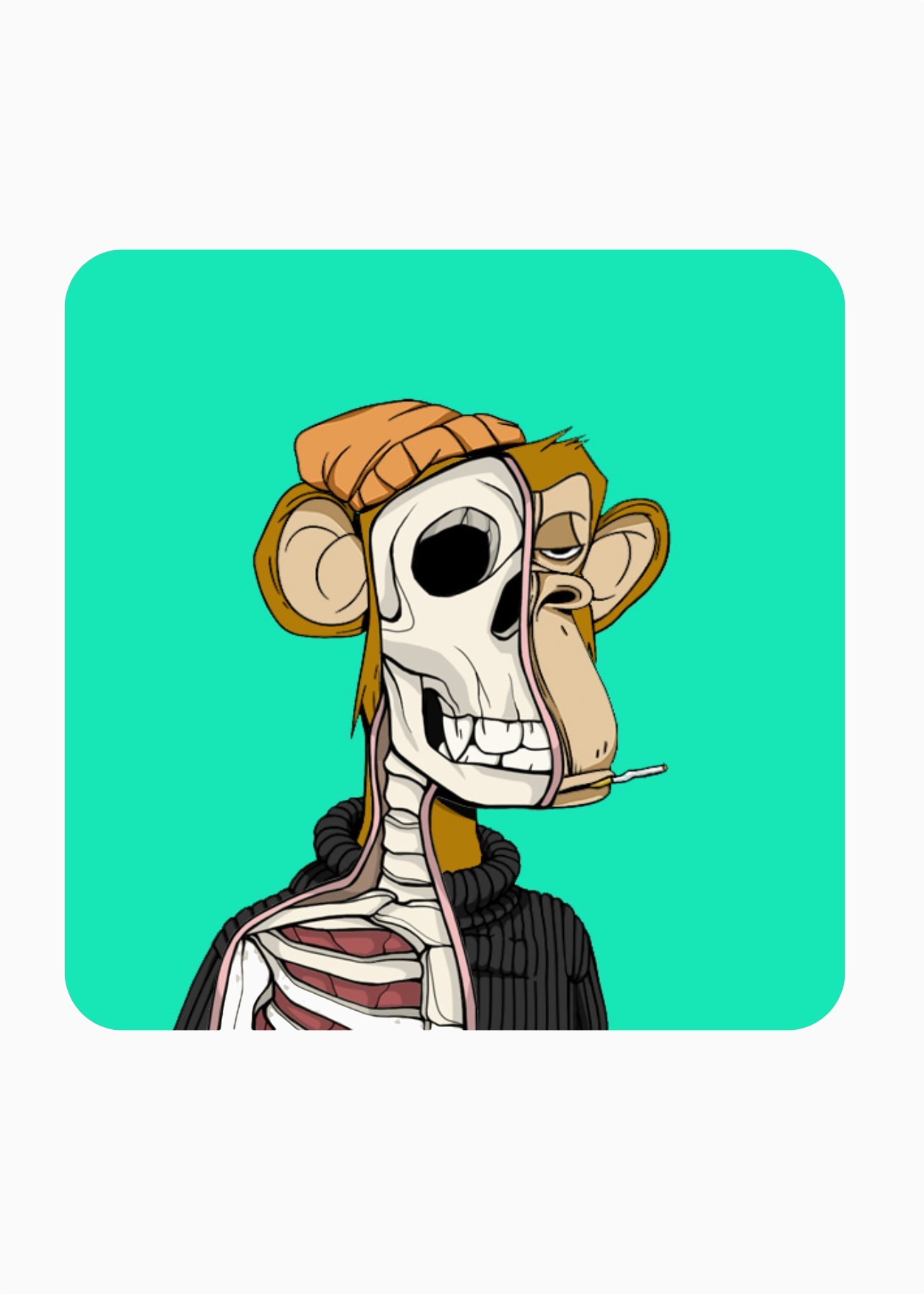

Certain NFT projects are now so popular that their value has increased exponentially. Market watchers even label several of these projects as blue-chip investments, including the Bored Ape Yacht Club.

Bored Ape NFTs are an exclusive collection of 10,000 original digital art images of apathetic-looking apes, each with their own unique characteristics and properties—varying fur types, clothing, accessories, facial expressions, and more.

Anatomy Science Ape Club Source Opensea.

Mutant Ape Yacht Club #1819 Source Opensea.

Mutant Ape Yacht Club #7713 Source Opensea.