NFT Scams

April 19, 2022

Two Men Charged with NFT Scams

Fraudulent NFT collections were once few and far between. However, it’s recently become increasingly difficult to figure out what budding or soon-to-launch NFT projects might be predatory.

An NFT project called Frosties was outed as a scam after its developers made off with over $1 million in ETH just hours after the project was launched. Ethan Nguyen and Andre Llacuna (both age 20) were both charged with conspiracy to commit wire fraud and conspiracy to commit money laundering after a criminal complaint was filed against them.

According to the U.S. Department of Justice, the duo sold the NFTs to investors but did not give them the “benefits advertised” after the transaction was complete. Instead, the funds from the sales went into different cryptocurrency wallets that the two operated.

Summary

Ethan Nguyen and Andre Llacuna were charged on Thursday, March 24, with money laundering and wire fraud. The prosecutor’s Complaints alleges that prior to their arrests, the two were allegedly preparing to launch the sale of yet another scam NFT project titled, “Embers” which, upon sell out, could’ve generated around $1.5 million in primary sales.

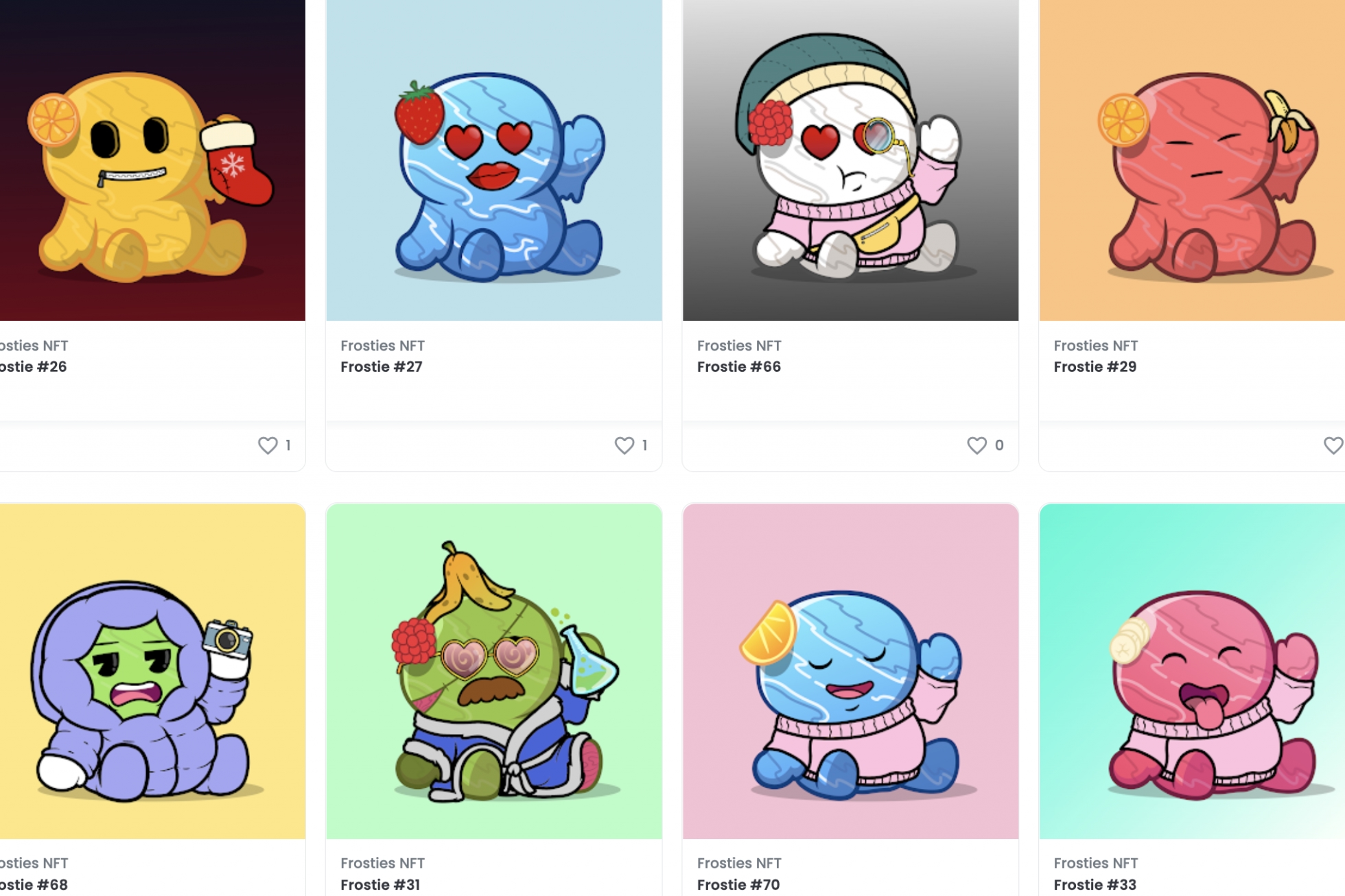

Frosties, an ice-cream-themed project, was originally billed as a “cool, delectable, and unique” collection of 8,888 NFTs on Frosties’ now unpublished website. Launched on January 7, the project’s developers promised raffles, merch, and even a “special fund to ensure the Frosties longevity.”

Each NFT was priced at 0.04 ETH per mint which means the project, upon sellout, had brought in 355 ETH (right around $1 million). Frosties sold out in a few short hours before the project’s Discord mysteriously disappeared.

In connection to the wrongdoings perpetrated by the Frosties project, Nguyen and Llacuna have each been charged with one count of conspiracy to commit wire fraud and one count of conspiracy to commit money laundering — each of which carries a maximum sentence of 20 years in prison.

This case will certainly act as a cautionary tale for future scammers, but this isn’t the first time that an NFT scam of this scale has been carried out. Quite the contrary actually, as this latest news of blockchain justice has served to highlight the growing need for accountability in the NFT space.

“NFTs have been around for several years, but recently mainstream interest has skyrocketed. Where there is money to be made, fraudsters will look for ways to steal it,” U.S. Attorney Damian Williams said in a press release. “As we allege, Mr. Nguyen and Mr. Llacuna promised investors the benefits of the Frosties NFTs, but when it sold out, they pulled the rug out from under the victims, almost immediately shutting down the website and transferring the money.”

Although the blockchain seems to be, at times, a lawless place, the Frosties case showcases that the U.S. justice department undoubtedly has the resources to pursue crime even in a space that thrives off of the idea of decentralization. More specifically, entities created to handle blockchain crime like HSI New York’s Dark Web & Cryptocurrency Task Force and even the IRS have the power to identify and shut down fraud.

Frosties Rug Pull

Are Crypto and NFT Rug Pulls Illegal?

Do NFTs by nature of their nascent presence in the fintech space, play by different rules than other types of investments? The answer, of course, is no.

“NFTs represent a new era for financial investments, but the same rules apply to an investment in an NFT or a real estate development,” Special Agent-in-Charge Thomas Fattorusso said in his March statement. “You can’t solicit funds for a business opportunity, abandon that business and abscond with money investors provided you.”

Risks and Remedies

The Justice Department isn’t fooling around. In February, the Justice Department announced it had appointed its first-ever crypto enforcement team director, Eun Young Choi, to head the National Cryptocurrency Enforcement Team (NCET). NFT enthusiasts shouldn’t discount law enforcement's resources or their ability to adequately follow blockchain crime.

According to the February press release, the NCET was established to ensure the department meets the challenge posed by the criminal misuse of cryptocurrencies and digital assets, and comprises attorneys from across the department, including prosecutors with backgrounds in cryptocurrency, cybercrime, money laundering, and forfeiture.

In her position as NCET Director, Choi will help identify, investigate, support, and pursue the department’s cases involving the criminal use of digital assets, with a particular focus on virtual currency exchanges, mixing and tumbling services, infrastructure providers, and other entities (NFT projects) that are enabling the misuse of cryptocurrency and related technologies to commit or facilitate criminal activity.

While there is no official law currently governing NFTs, there are still ways by which individuals can be held criminally liable and prosecuted, specifically for fraud, money laundering, and of course, conspiracy to commit fraud and money laundering.

A month after appointing Choi and establishing NCET, the DOJ announced it had seized nearly $3.5 billion in cryptocurrency, after arresting husband and wife Illya Lichtenstein and Heather Morgan in connection with laundering it.

Despite what many believe about the federal government not having the appropriate resources to handle criminal acts of this magnitude with this new form of technology, Frosties should be a clear warning to all that regulators are paying close attention to NFTs, while the federal government still is capable of exerting its resources to unwind complex transactions and to help unmask perpetrators who attempt to remain anonymous.